The irs also directs taxpayers to attach if received any 1099 r form w 2c and form 2439. How to attach w2 to 1040 tax form.

You dont need to send your forms w 2 to the irs and should keep them in a safe place with a copy of your tax return.

How to attach w2 to 1040 form.

Only staple these forms to the first page of your 1040 do not allow your staple to go through all the forms in your return.

Find the federal copy of each form and staple them to the front of your 1040 in the income section.

Corner of the schedule or form.

Do you use stapler or paper clip.

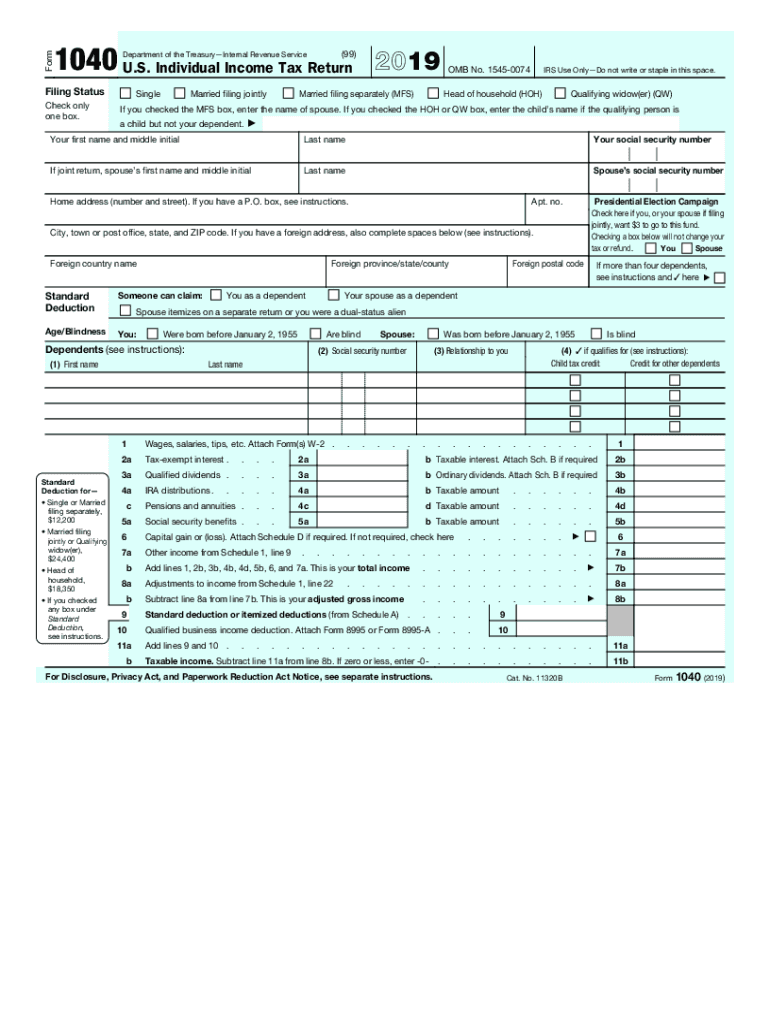

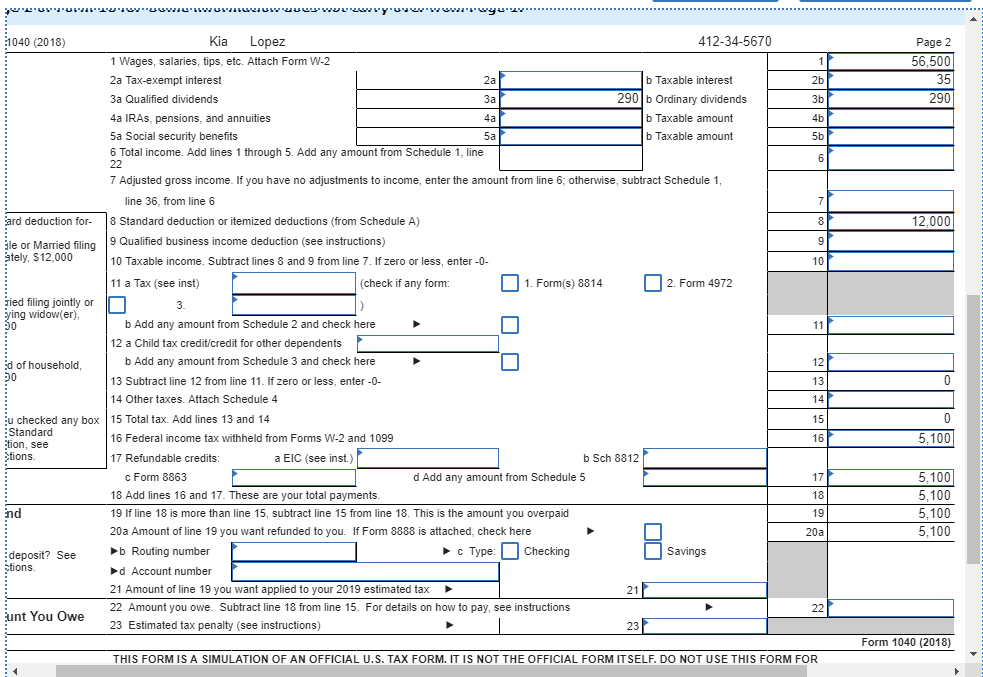

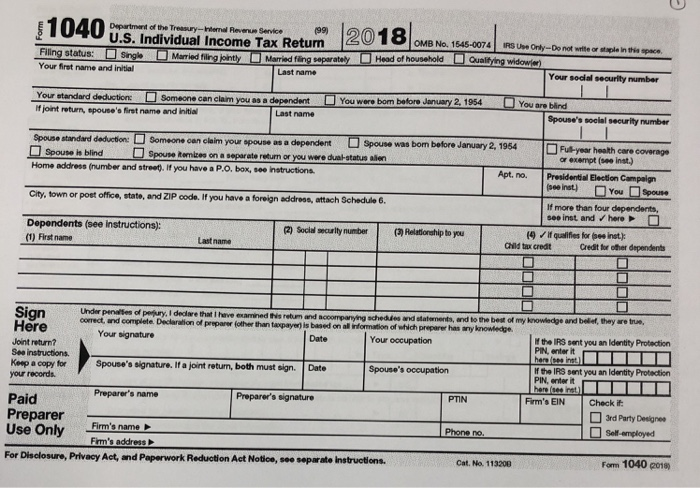

Attachments to the 1040 form taxpayers who mail in their tax returns attach their w 2s to the front of the individual tax return form used.

Look for the instruction attach w 2 forms here in the middle of the page at the left margin.

Attach a copy of forms w 2 w 2g and 2439 to the front of form 1040.

Unless you see instructions on your filing instructions page youre done once the irs accepts your e filed return.

You must provide a copy of your forms w 2 to the authorized irs e file provider before the provider sends the electronic return to the irs.

The internal revenue service requires you to submit most forms and schedules used to prepare paper returns.

Youll receive a few copies of each income document thats mailed to you.

Thats the beauty of electronically filing your tax returns.

Also attach forms 1099 r if tax was withheld.

For supporting statements arrange them in the same order as the schedules or forms they support and attach them last.

Also should i staple the entire tax return of 5 pages.

Instructions for irs form 1040 state that you only need to attach supplemental forms if federal taxes were withheld.

Attach w 2 and 1099 income documents.

The irss instructions dont specify a method but stapling the w 2 to the return reduces the risk that it will be lost or separated from the return.

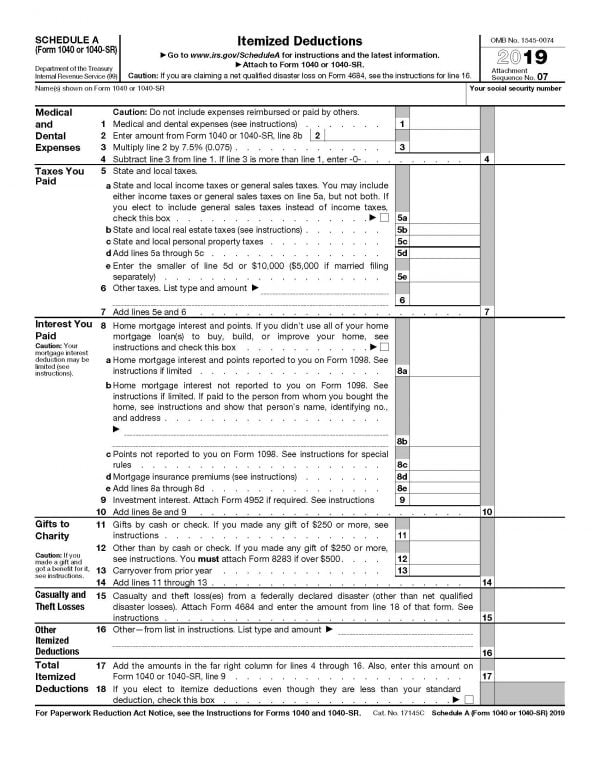

There are required form 1040 attachments but it is not necessary to send all documents used in your preparation.

Because no federal income taxes or social security and medical contributions are typically withheld from earnings reported on the form 1099 misc you likely wont need to attach it to your return only statements that prove withholding should be attached.

If you electronically filed e filed your tax return you do not have to sign or mail anything.

Although the tax information you receive each year and the forms and items you use to calculate your return all appear to be things you should attach there are a few key.

Use the coded envelope included with your tax package to mail your return.

Attach your w 2 to the front of the return at the line on which you report your wages and salary line 7 on form 1040 or form 1040a and line 1 on form 1040ez.

The irs receives a copy of your w 2 and other information.

/28061847524_d276393b0a_k-226e784d8d3846f4a1491612274b125d.jpg)

/1040-NR-EZ-NonresidentAlienswithNoDependents-1-992eb3e7ab6d49b782ad46ab42ae00e5.png)

No comments:

Post a Comment