If you did not receive an envelope check the section called where do you file inside the back cover of the your tax instruction booklet. Youll receive a few copies of each income document thats mailed to you.

Since alternate versions of your income forms are not created when you send a paper return you must attach copies of your physical w 2s and 1099s to the front page of your 1040 form.

How to attach w2 to 1040.

Do not attach correspondence or other items unless required to do so.

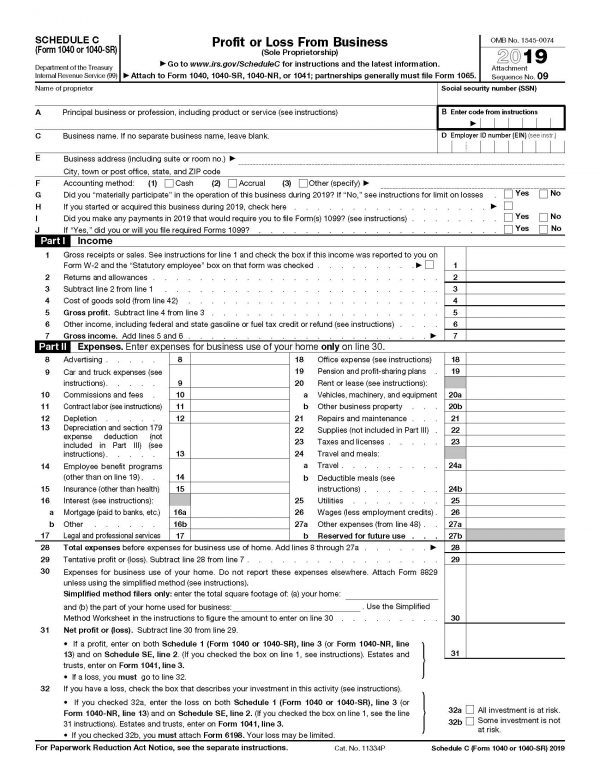

Although you may receive multiple forms at the end of the year to help prepare your return you only need to attach forms that show types of income you received.

Attach w 2 and 1099 income documents.

Attach a copy of forms w 2 w 2g and 2439 to the front of form 1040.

You need not do any attachments for filing your w 2.

Find the federal copy of each form and staple them to the front of your 1040 in the income section.

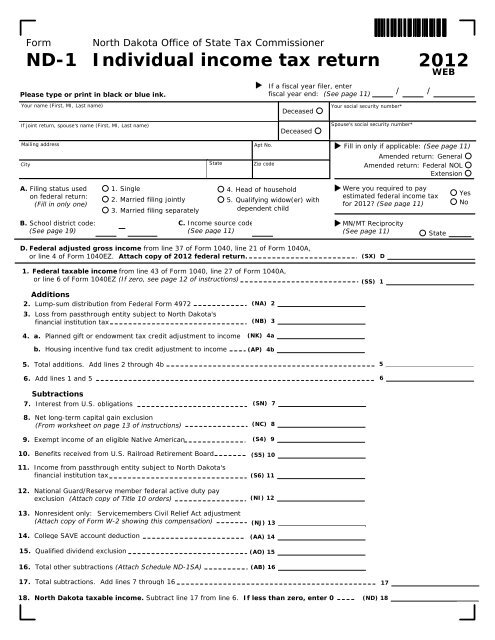

You may be mailing your return to a different service center this year because the irs.

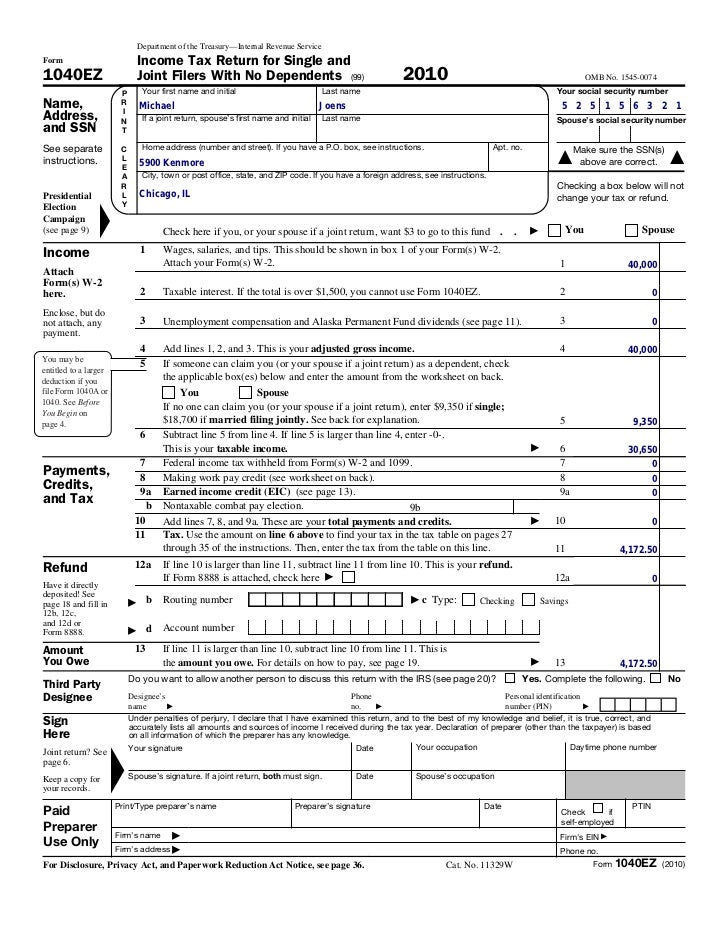

Attach your w 2 to the front of the return at the line on which you report your wages and salary line 7 on form 1040 or form 1040a and line 1 on form 1040ez.

Youll receive a few copies of each income document thats mailed to you.

Also attach forms 1099 r if tax was withheld.

If you received a form w 2c a corrected form w 2 attach your original forms w 2 and any forms w 2c.

Please let me know if i can be of further assistance to you regarding this matter.

Staple all your forms and schedules together in the upper right corner.

Attach forms w 2 and 2439 to the front of form 1040.

When i used to send in paper returns i would staple the w2s to the 1040 in the section where required.

You dont need to send your forms w 2 to the irs and should keep them in a safe place with a copy of your tax return.

Use the coded envelope included with your tax package to mail your return.

Attach w 2 and 1099 income documents.

Only staple these forms to the first page of your 1040 do not allow your staple to go through all the forms in your return.

Individual income tax transmittal for an irs e file return to submit any paper documents that need to be sent after your return has been accepted electronically.

Find the federal copy of each form and staple them to the front of your 1040 in the income section.

Use form 8453 us.

The irss instructions dont specify a method but stapling the w 2 to the return reduces the risk that it will be lost or separated from the return.

You can either import w 2 into your return or you can go to federal taxes wages and income to enter your w 2 information.

Attach forms w 2g and 1099 r to the front of form 1040 if tax was withheld.

Also you are allowed to staple the pages together just dont staple the 1040 in the upper right corner of the form.

/1040-Page1-e7bbe01bc7824e54a552dfab83fff0b6.jpg)

No comments:

Post a Comment